Interesting document from Videonet on the future of content discovery and its benefits for adressable TV

Content discovery and synchronization

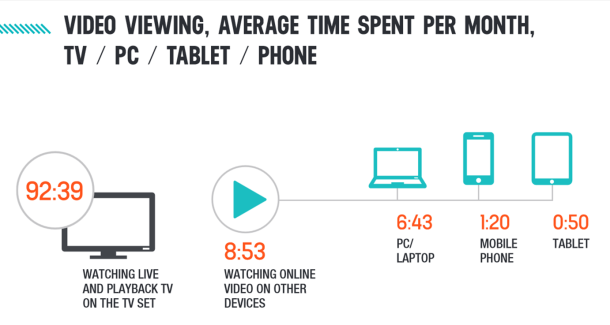

With access to rich data about their subscribers and what they do, operators can improve recommendation, encourage social TV and exploit second screen synchronization.

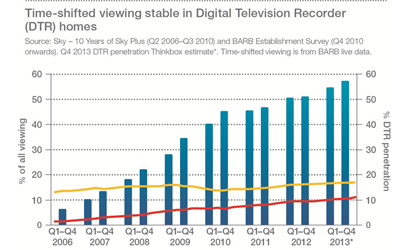

Recordings get more personal

One of the next big steps in multiscreen TV is giving people access to their personal recordings on every screen. This is the moment for nPVR to finally make its entrance.

Evolving the User Experience

As service providers go beyond household level and address individuals, the role of log-ins or context will become important. There is a place for social TV and big data.

The role of audio in personalization

Audio has a huge impact on how much we enjoy video services. Now it can help to personalize them. ‘Allegiance’ based audio choices are one possibility.

Making advertising more targeted

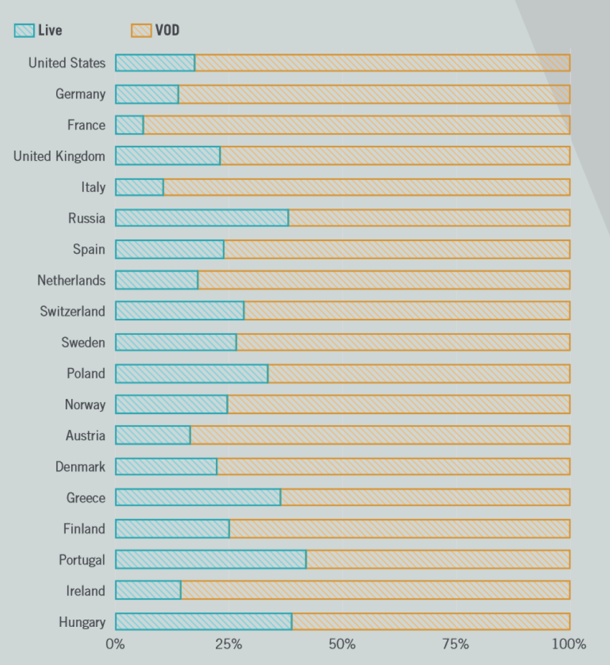

Addressable advertising is in its infancy but has a bright future, helping to fund the growth of on-demand and multiscreen viewing.

You can download the document here